Top Guidelines Of zero down bankruptcy virginia

This chapter of your Bankruptcy Code gives for adjustment of debts of a person with common revenue. Chapter thirteen lets a debtor to keep residence and pay back debts over time, generally 3 to five years.

Invoice and Kathy had to repay the court docket fees and back taxes they owed. They had to become recent on their own house loan and auto payments. The judge discharged 50 % of their charge card financial debt.

Unlike Chapter 7 bankruptcy, Chapter thirteen doesn’t eradicate most debts. But it really does give borrowers a crack from assortment endeavours and will quit moves by creditors to consider your private home, car or truck or other residence.

But this payment won't affect the information we publish, or even the critiques that you simply see on this site. We do not involve the universe of corporations or fiscal gives that may be accessible to you.

Vehicle payments gained’t be refunded but will be credited in your account. Payments will go to the trustee immediately or as a result of payroll deduction. When you fail to produce the verified program payments, the court docket might dismiss the case or transform it to the Chapter 7 liquidation situation.

Within the debtor's person tax return, Sort 1040 or 1040-SR, report all cash flow been given over the whole year and deduct all allowable costs. Never include in revenue the quantity from any financial debt canceled mainly because of the debtor's bankruptcy.

Usually, the bankruptcy court docket has the authority to determine the quantity or legality of any tax imposed on the debtor beneath its jurisdiction and the bankruptcy estate, such as any great, penalty, or addition to tax, if the tax was previously assessed or paid.

Basically, Chapter thirteen purchases you time to Get the money act alongside one another. It extends the amount of time You need useful reference to repay Everything you owe following the bankruptcy courtroom difficulties its ruling.

Chapter 13 may be beneficial for people with really serious debts who be concerned about losing their properties to bankruptcy. When you adhere towards your repayment prepare, you’ll Possess a new lease on economical lifestyle.

In case the election is manufactured, the debtor's federal cash flow tax liability for the 1st shorter tax calendar year will become an allowable declare towards Resources the bankruptcy estate arising ahead of the bankruptcy filing. Also, the tax legal responsibility for the main brief tax calendar year isn't really issue to discharge beneath the Bankruptcy Code.

In case you are working with a foreclosure or repossession, these will halt. Phone calls, e-mail, along with other Get in touch with from creditors will even be routed in Our site your bankruptcy attorney. An automatic stay will not be set into area or will be limited if you have now filed for bankruptcy when or more in the final twelve months.

The bankruptcy court has the ability to lift the automatic stay and allow the debtor to start or proceed a Tax Court docket case.

When the debtor files a petition with the bankruptcy court, the debtor gets the protection of the automated remain.

A Chapter thirteen bankruptcy normally stays on your credit reports official source for 7 yrs through the date you filed the petition. It can lower your credit history rating by close to a hundred thirty to 200 points, but the effects on your credit history diminish after some time. When you restore your credit, it could be challenging to qualify for new financial loans or other kinds of credit. There’s also pressure to maintain up with the three- to 5-12 months prepare simply because missing payments could lead to your dismissal. In that scenario, you stand to lose any assets you ended up attempting to protect. Due to this, Chapter 13 bankruptcy ought to be utilized as a woodbridge bankruptcy attorney last resort. Ways to file for Chapter 13

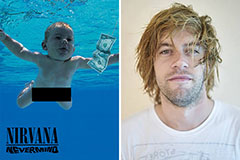

Spencer Elden Then & Now!

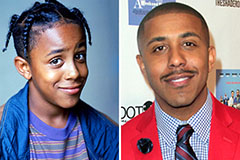

Spencer Elden Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! David Faustino Then & Now!

David Faustino Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now!